Introduction: Why the New Wage Definition Matters

India’s Code on Wages, 2019 has introduced a unified and legally binding definition of “wages,” reshaping how employers structure salaries and calculate statutory dues. By standardizing what counts as wages and capping exclusions at 50% of total remuneration, the Code ensures transparency, prevents allowance-heavy salary structures, and strengthens employee entitlements such as PF, gratuity, and minimum wage compliance. For employers, this shift requires a careful restructuring of payroll systems and employment contracts to remain compliant and avoid statutory risks.

What Legally Counts as “Wages” Under Section 2(y)

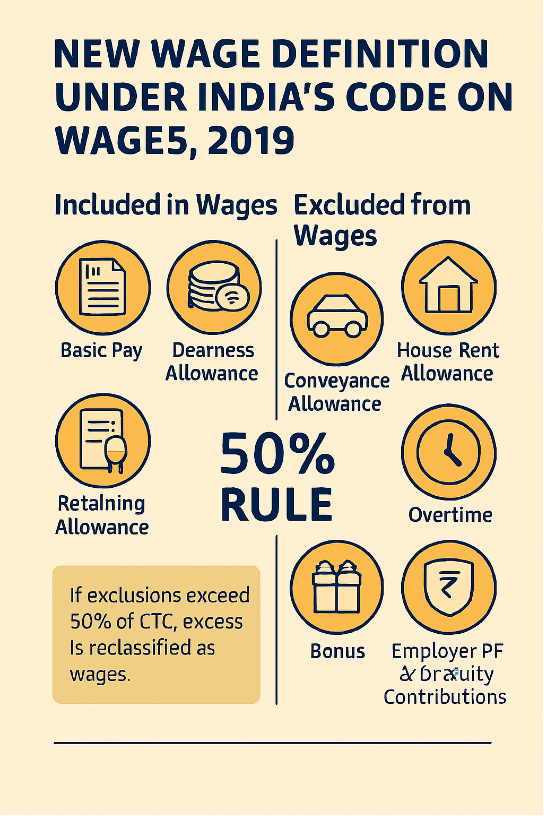

The Code on Wages, 2019 defines “wages” as the core earnings payable to an employee for work performed. Only three components are included:

- Basic Pay

- Dearness Allowance (DA)

- Retaining Allowance (if applicable)

These three components form the statutory wage base, which is used to calculate statutory benefits such as:

- Minimum wages

- Overtime wages

- Provident Fund contributions

- Gratuity

- Bonus eligibility

- Other statutory dues

Important:

PF, gratuity, bonus, and overtime are not part of wages, they are calculated based on wages.

What Is Excluded From Wages

The Code explicitly excludes the following from the wage base:

- Statutory bonus

- House Rent Allowance (HRA)

- Conveyance allowance

- Overtime premium

- Commission

- Employer PF contributions

- Employer gratuity contributions

- Retrenchment compensation

- Ex-gratia termination payments

- Reimbursements for official duties

- Court-ordered payments

These exclusions prevent employers from artificially reducing the wage base by inflating allowances.

The 50% Threshold Rule Explained

The Code introduces a critical compliance safeguard:

Excluded components cannot exceed 50% of total remuneration.

If exclusions exceed 50%, the excess amount is added back to wages.

This ensures:

- At least half of CTC is treated as wages

- PF and gratuity are calculated on a meaningful base

- Employers cannot bypass statutory obligations

How the New Wage Definition Impacts Statutory Benefits

1. Provident Fund (PF)

PF must now be calculated on a wage base that reflects at least 50% of total remuneration, unless exclusions fall below the threshold.

2. Gratuity

Gratuity continues to be governed by the Payment of Gratuity Act, 1972.

The formula itself has not changed, but the wage base used in the formula has changed.

Because “wages” now mean Basic + DA + Retaining Allowance (subject to the 50% rule), gratuity calculations will be based on a broader and more accurate wage figure, especially for employees previously placed on allowance-heavy structures.

3. Overtime

Overtime wages must be calculated on the statutory wage base, ensuring uniformity across states.

4. Bonus Eligibility

The unified wage definition reduces disputes and standardizes bonus eligibility thresholds.

Impact on Gratuity Calculation (Corrected & Legally Safe)

The new wage definition significantly affects gratuity because it changes what counts as “wages” for the purpose of the calculation.

Key points:

- Gratuity continues to be linked to the employee’s last drawn wages.

- “Wages” now mean Basic + DA + Retaining Allowance, after applying the 50% exclusion cap.

- Allowances cannot be used to artificially reduce the wage base.

This results in:

- Higher gratuity payouts for employees with allowance-heavy CTC structures

- A more accurate reflection of actual earnings

- Reduced disputes over calculation methods

Note:

Avoid stating a fixed formula in compliance blogs unless quoting the Act verbatim.

The focus should remain on the wage base, not the arithmetic.

Floor Wage vs State Minimum Wages

The Code introduces a national floor wage, below which no state can set its minimum wage.

States may:

- Set higher minimum wages

- Adjust based on local cost of living

- Notify periodic revisions

This ensures uniform protection and prevents wage undercutting.

Treatment of In-Kind Benefits

Employers may include in-kind benefits (e.g., meals, uniforms, accommodation) as part of wages up to 15% of total wages.

If in-kind benefits exceed 15%, the excess may be treated as monetary wages.

This provision:

- Supports sectors like hospitality and manufacturing

- Prevents misuse of non-cash perks to reduce statutory liabilities

Old vs New Wage Definition (Comparison Table)

| Aspect | Old Wage Defination (Pre-Code Era) | New Wage Defination (Code on Wages, 2019) |

| Legal Basis | Multiple laws with inconsistent definitions | Single unified defination across all labour codes |

| Core Components | Varied across laws | Basic + DA + Retaining Allowance |

| Allowances | Could be inflated to reduce PF/gratuity | Allowance capped at 50% of CTC |

| Reclassification Rule | No mechanism | Excess allowances added back to Wages |

| PF Impact | Often calculated on low basic pay | PF calculated on a broader wage base |

| Gratuity Impact | Lower payouts | Higher payouts due to expanded wage base |

| Minimum Wage Calculation | State-wise variations | Uniformal national wage defination |

| Overtime Calculation | Inconsistent | Based on statutory wage base |

| Litigation Risk | High | Reduced due to standardization |

| In-Kind Benefits | No clear cap | Allowed up to 15% of wages |

Employer Compliance Checklist

1. Review Salary Structures

Audit current CTC breakdowns to identify non-compliant wage-to-allowance ratios.

2. Adjust Basic + DA

Ensure these components form at least 50% of total remuneration.

3. Reclassify Allowances

Reduce inflated allowances that exceed the 50% cap.

4. Update Employment Contracts

Insert clauses referencing the new wage definition and statutory obligations.

5. Update Payroll Systems

Ensure automated calculations reflect the new wage structure.

6. Communicate With Employees

Explain changes in take-home pay, PF deductions, and gratuity impact.

7. Maintain Documentation

Keep revised salary sheets, contracts, and audit trails for inspections.

Conclusion: A More Transparent Wage Framework

The new wage definition under the Code on Wages, 2019 marks a decisive shift toward transparency, fairness, and uniformity in India’s labour ecosystem. By ensuring that core earnings—not inflated allowances—drive statutory benefits, the Code strengthens employee security while guiding employers toward responsible compensation practices. Aligning payroll systems with this definition is not just a compliance requirement — it is a long-term investment in trust, clarity, and workforce stability.

Join the Conversation

Your thoughts matter. Share your perspective in the comments—healthy dialogue helps us all understand labour law better.

Need Guidance?

Feel free to book a consultation. Expert advice can make compliance smoother and more effective.

Spread the Knowledge

If you found this article useful, don’t keep it to yourself—share it with colleagues, friends, or on social media. Together, we can build greater awareness of labour rights and responsibilities.

Disclaimer – This blog post is a general guide. It should not be considered legal advice. Consult a legal professional for more details.