India’s new Labour Codes covering wages, industrial relations, social security, and workplace safety introduce a unified compliance framework that strengthens worker protections while easing the burden on smaller businesses. With penalties now scaled to violation severity, exemptions tailored for MSMEs, and new coverage for gig and platform workers, the Codes reflect a modernized approach to labour governance. As these reforms take effect through late 2025 notifications, employers must update contracts, payroll structures, and registration processes to avoid escalating penalties and ensure seamless compliance.

1. How Penalties Differ Between the Code on Wages and the Industrial Relations Code

Code on Wages, 2019 — Penalties

The Code on Wages focuses on monetary violations such as:

- Non-payment or delayed payment of wages

- Minimum wage shortfalls

- Incorrect wage deductions

- Failure to maintain wage records

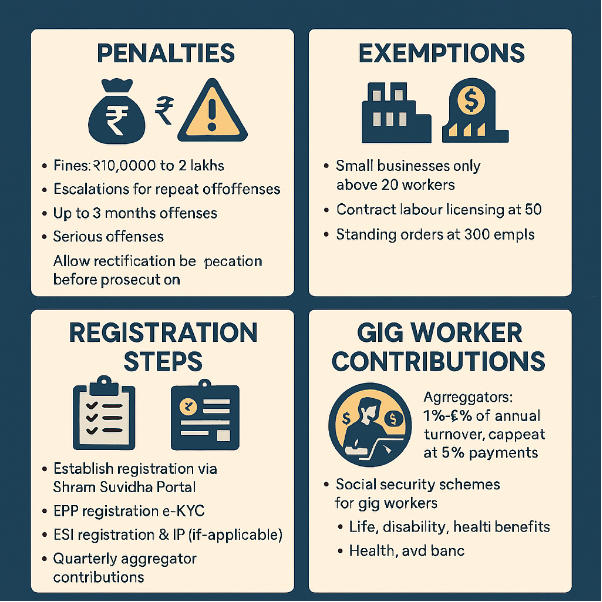

Penalty structure:

- ₹10,000 to ₹1 lakh for first-time wage violations

- Up to 3 months imprisonment + ₹1 lakh fine for repeat offences

- Compounding allowed at 50% of maximum penalty

The emphasis is on rectification, not criminalization, unless the employer repeats the offence within three years.

Industrial Relations [IR] Code, 2020 — Penalties

The IR Code deals with:

- Illegal strikes/lockouts

- Breach of standing orders

- Failure to follow retrenchment/closure procedures

- Violations in trade union recognition

Penalty structure:

- ₹50,000 to ₹2 lakhs for illegal strikes or lockouts

- ₹1 lakh to ₹10 lakhs for violating lay-off, retrenchment, or closure conditions

- ₹2,000 per day for continuing violations

- Imprisonment provisions apply for serious breaches

Key difference:

- Wage Code = financial violations

- IR Code = industrial discipline, employment security, and dispute management

2. Which Businesses Are Exempt From Each Labour Code Compliance Requirement Code on Wages

Applies universally to all employees—no salary threshold, no establishment size exemption.

OSH Code (Occupational Safety, Health & Working Conditions)

Exemptions based on establishment type:

| Requirement | Applicability |

| Factory registration | 20 workers with power, 40 without power |

| Contract labour licence | 50 or more contract workers |

| Creche facility | 50 or more employees |

| Standing orders | 300 or more workers |

MSMEs benefit from:

- Relaxed inspections

- Self-certification options

- Startup-friendly compliance windows

Industrial Relations Code

Standing Orders apply only to establishments with 300+ workers.

Small units are exempt from:

- Works committee requirements

- Trade union recognition obligations

- Retrenchment/closure permissions (below 300 workers)

Code on Social Security

Applies broadly, but exemptions exist:

| Scheme | Applicability |

| EPF | Establishments with 20+ employees |

| ESI | Establishments with 10+ employees (or as notified) |

| Gig/platform worker | All aggregators, regardless of size |

| Gratuity | All employees; fixed-term employees eligible proportionately |

3. Steps for Registering Employees Under the Code on Social Security (Especially for MSMEs)

MSMEs must complete the following steps:

Step 1: Obtain Establishment Registration on Shram Suvidha Portal

- Use PAN, GST, and business details

- Unified registration covers EPF, ESI, CLRA, ISMW, and BOCW

Step 2: Register Employees Under EPF

- Upload employee KYC (Aadhaar, PAN, bank details)

- Generate UAN (Universal Account Number)

- Link UAN with Aadhaar for e-KYC

Step 3: Register Employees Under ESI (if applicable)

- Generate IP (Insured Person) number

- Upload family details for medical benefits

- Activate Pehchan card

Step 4: Register Gig/Platform Workers (if applicable)

- Upload worker details

- Map them to aggregator category

- Ensure contribution compliance (1–2% of turnover)

Step 5: Monthly Compliance Filing

- PF: ECR filing

- ESI: Monthly contribution challan

- Gig workers: Quarterly aggregator contribution filing

4. Model Contract Clauses to Align With the New Wage Definition

Clause 1: Wage Structure Compliance

“The Employee’s wages shall comprise Basic Pay, Dearness Allowance, and Retaining Allowance (if applicable), which together shall constitute not less than fifty percent (50%) of the total remuneration, in accordance with Section 2(y) of the Code on Wages, 2019.”

Clause 2: Allowance Reclassification

“If the aggregate value of excluded components exceeds fifty percent (50%) of total remuneration, the excess shall be deemed wages for the purpose of statutory contributions and benefits.”

Clause 3: Statutory Benefits

“All statutory benefits including provident fund, gratuity, bonus eligibility, and overtime shall be computed on the wage definition prescribed under applicable Labour Codes.”

Clause 4: Fixed-Term Employee Parity

“A fixed-term employee shall receive wages, allowances, and statutory benefits equivalent to those of a permanent employee performing similar work.”

5. How to Calculate Statutory Contributions for Gig Platform Workers

Under the Code on Social Security, 2020, gig and platform workers are covered through a dedicated welfare fund.

Aggregator Contribution Formula

Aggregators must contribute:

– 1% to 2% of their annual turnover,

– capped at 5% of the total payments made to gig/platform workers.

Turnover excludes:

- Taxes

- Payments to third-party vendors

Worker Contribution

Gig and platform workers may contribute voluntarily, but no mandatory deduction is permitted from their earnings.

Benefits Covered

- Life and disability cover

- Accident insurance

- Health and maternity benefits

- Old age protection

- Skill development and other welfare measures

This framework represents India’s first formal social security net for non‑traditional digital workers, as confirmed by the Ministry of Labour.

Conclusion –

India’s Labour Codes mark a decisive shift toward a more transparent, predictable, and future-ready compliance ecosystem. By unifying penalties, simplifying exemptions for MSMEs, formalizing gig-worker protections, and redefining wages with mathematical clarity, the Codes push employers toward structured, accountable, and worker-centric practices.

The message for businesses is clear:

compliance is no longer a paperwork exercise — it is a strategic necessity.

Those who proactively realign contracts, update payroll systems, register workers under the Social Security Code, and adopt fair wage structures will not only avoid escalating penalties but also build stronger, more resilient workplaces.

As India’s labour landscape evolves, early adopters of these reforms will stand out as responsible employers who value transparency, legal certainty, and long-term workforce trust. The Codes are not just regulatory mandates — they are an opportunity to modernize employment practices and strengthen the foundation of India’s growing economy.

Join the Conversation

Your thoughts matter. Share your perspective in the comments—healthy dialogue helps us all understand labour law better.

Need Guidance?

Feel free to book a consultation. Expert advice can make compliance smoother and more effective.

Spread the Knowledge

If you found this article useful, don’t keep it to yourself—share it with colleagues, friends, or on social media. Together, we can build greater awareness of labour rights and responsibilities.

Disclaimer – This blog post is a general guide. It should not be considered legal advice. Consult a legal professional for more details.