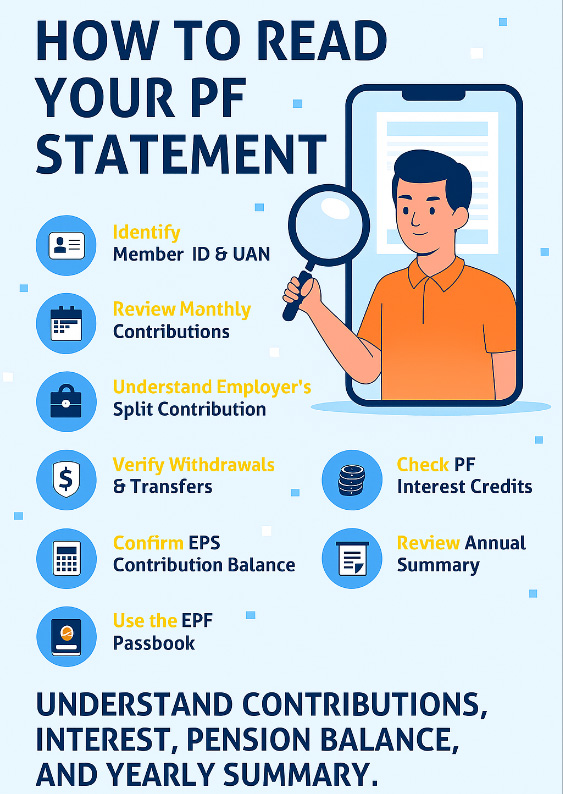

Understanding your Provident Fund (PF) statement is one of the simplest yet most powerful steps you can take toward securing your financial future. Your PF passbook is more than just a record of monthly deductions, it reveals how much you and your employer contribute, how your retirement corpus is growing, and whether your account is being managed correctly. This guide breaks down each section of the PF statement in clear, practical terms so you can confidently track your retirement savings and make informed financial decisions.

Below is a clear, structured guide to understanding each component of your PF statement.

- Identify Your Member ID and UAN

Every PF account is linked to two identifiers: - Member ID

- A unique number generated for each employer you work with.

- When you change jobs, a new Member ID is created under the same UAN.

UAN (Universal Account Number)

- A permanent 12-digit number allotted by EPFO.

- Remains the same throughout your career.

- Allows you to view all PF accounts, update KYC, and track service history through the EPFO portal or UMANG app.

Why this matters:

Your UAN acts as the central link between all your PF accounts, ensuring continuity and transparency in your retirement savings.

- Review Monthly Contribution Details

Your PF statement shows the monthly contributions made by both you and your employer.

Employee Contribution

- Typically 12% of Basic + DA.

- The entire amount goes into your EPF account.

Employer Contribution

Your employer also contributes 12% of Basic + DA, but this amount is divided between EPF and EPS as per statutory rules:

- Contribution to EPS (Pension Scheme) – 8.33%

- 8.33% of Basic + DA goes to the Employee Pension Scheme (EPS).

- Capped at ₹1,250 per month (8.33% of ₹15,000).

- If your Basic + DA exceeds ₹15,000, EPS contribution remains ₹1,250 unless a higher-pension option is exercised.

2. Contribution to EPF – Remaining Portion

- After deducting the EPS share, the balance of the employer’s 12% goes to EPF.

- For wages up to ₹15,000 → EPF share = 3.67%

- For wages above ₹15,000 → EPF share = 12% – ₹1,250

Total Contribution

- Employee EPF: 12% of Basic + DA

- Employer EPF: Variable (depends on EPS cap)

- Employer EPS: Up to ₹1,250 per month

- Total monthly deposit = Employee EPF + Employer EPF + Employer EPS

Why this matters:

This section helps you verify whether your employer is depositing PF contributions correctly and on time, as required under the EPF Act.

- Understand How Employer Contribution Appears in Your Statement

Many employees assume the employer contributes the full 12% to EPF, but the law requires a split between EPF and EPS.

EPF Share

The portion of the employer’s contribution that goes directly into your PF balance.

EPS Share

Transferred to the Employee Pension Scheme and does not appear in your PF balance, as EPS is maintained separately.

Important:

EPS contributions do not earn interest and are used to calculate your pension after age 58.

- Check the Interest Credited to Your PF

EPFO declares the PF interest rate annually through a government notification.

Interest is:

- Calculated monthly

- Credited at the end of the financial year

Your statement will show:

- Interest on employee contribution

- Interest on employer contribution

Key Points

- PF interest is tax-free (subject to notified limits).

- Interest is compounded annually, helping your retirement corpus grow steadily.

- Verify Withdrawals and Transfers

Your PF statement records all fund movements.

Withdrawals

May include:

- Partial withdrawals for housing, medical needs, education, or marriage

- Full withdrawal after retirement or unemployment

Transfers

If you changed jobs and transferred your old PF balance to the new Member ID, the transfer entry will appear here.

Why this matters:

This section ensures that no unauthorized withdrawals have occurred and that all transfers are properly reflected.

- Check Your Pension (EPS) Contribution Balance

Although EPS contributions do not earn interest, your statement may show:

Pension Contribution Balance

- Total amount deposited under EPS

- Managed separately by EPFO

- Withdrawable only under specific conditions (Form 10C or Form 10D)

Why this matters:

EPS forms the basis of your monthly pension after age 58, making it a crucial part of your retirement planning.

- Review the Annual Summary

Most PF statements include a yearly summary showing:

- Opening balance at the start of the financial year

- Total contributions (employee + employer)

- Interest credited

- Closing balance at year-end

Why this matters:

This snapshot helps you track long-term growth and verify whether contributions and interest have been credited correctly.

- Use the EPF Passbook for Detailed Tracking

The EPF passbook provides a month-wise breakdown of all transactions.

How to Access

- Visit the EPFO Passbook Portal

- Log in using your UAN and password

- Download the passbook for each Member ID

What It Shows

- Monthly contributions

- Interest credits

- Withdrawals

- Transfers

- Opening and closing balances

Why this matters:

The passbook is the most transparent and up-to-date record of your PF account, essential for audits, compliance checks, and personal financial planning.

Conclusion

Reading your PF statement is not just a routine task — it is a powerful financial habit. By understanding your contributions, interest earnings, pension balance, and annual summary, you gain complete visibility into your retirement savings. Regularly reviewing your PF passbook helps detect discrepancies early and ensures your long-term financial security remains on track.

Join the Conversation

Your thoughts matter. Share your perspective in the comments—healthy dialogue helps us all understand labour law better.

Need Guidance?

Feel free to book a consultation. Expert advice can make compliance smoother and more effective.

Spread the Knowledge

If you found this article useful, don’t keep it to yourself—share it with colleagues, friends, or on social media. Together, we can build greater awareness of labour rights and responsibilities.

Disclaimer – This blog post is a general guide. It should not be considered legal advice. Consult a legal professional for more details.