India’s New Labour Codes 2025 have introduced a uniform wage definition that mandates at least 50% of an employee’s total cost-to-company (CTC) be classified as “wages.” This change impacts how employers calculate PF, gratuity, and bonuses, and requires a strategic restructuring of employment contracts. In this blog, we explore how businesses can realign their salary structures, avoid compliance pitfalls, and ensure lawful, transparent compensation practices under the new framework.

Key Provisions and Compliance Requirements

What Counts as “Wages”

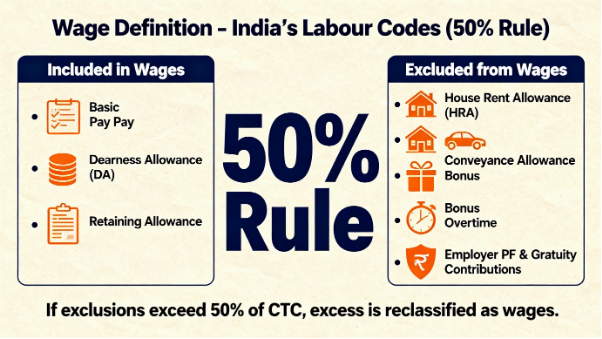

Under the Code on Wages, 2019, the term “wages” includes:

- Basic Pay

- Dearness Allowance (DA)

- Retaining Allowance (if any)

These must collectively form at least 50% of the total remuneration. If they fall short, the excess allowances are reclassified as wages for PF, ESI, and gratuity calculations.

What Is Excluded

The following components are excluded from wage calculation:

- House Rent Allowance (HRA)

- Conveyance allowance

- Bonus (statutory or performance-based)

- Overtime payments

- Commission

- Employer PF contributions

- Gratuity

However, exclusions cannot exceed 50% of the total CTC. If they do, the excess is added back to wages.

How to Restructure Contracts

Step-by-Step:

- Audit existing contracts: Identify components that fall outside the new wage definition.

- Reclassify allowances: Reduce inflated allowances and increase basic pay to meet the 50% threshold.

- Update statutory clauses: Clearly define PF, ESI, and gratuity applicability based on revised wages.

- Include compliance language: Add clauses referencing the Code on Wages and statutory obligations.

- Digitize payroll systems: Ensure automated calculations reflect the new wage structure.

- Communicate changes: Inform employees about the restructuring and its impact on take-home pay and benefits.

Sample Clause for Employment Contracts (Wage Definition Compliance)

Compensation Structure Clause

“The employee’s total remuneration shall be structured in accordance with the wage definition prescribed under the Code on Wages, 2019. Accordingly, the components classified as ‘wages’—including Basic Pay, Dearness Allowance, and Retaining Allowance (if applicable)—shall constitute not less than fifty percent (50%) of the total cost-to-company (CTC). Any allowances exceeding the permissible exclusion threshold shall be reclassified as wages for the purpose of calculating statutory benefits such as Provident Fund, Gratuity, Bonus, and ESI contributions. This structure is subject to periodic review to ensure continued compliance with applicable labour laws.”

Legal Risks of Non-Compliance

- PF and ESI under-deductions may trigger penalties and interest.

- Gratuity miscalculations can lead to employee disputes and litigation.

- Misclassification of wages may result in minimum wage violations.

Employer Compliance Checklist: Wage Definition Alignment

| Task | Description |

| Audit Salary Structures | Review current CTC breakdowns to identify non-compliant ratios. |

| Reclassify Allowances | Reduce HRA, special allowances, and reimbursements if they exceed 50% of CTC. |

| Increase Basic Pay | Adjust Basic + DA to meet the 50% wage threshold. |

| Update Contracts | Insert wage compliance clauses and revise offer letters. |

| Align Payroll Systems | Ensure automated calculations reflect new wage ratios for PF, ESI, and gratuity. |

| Train HR & Finance Teams | Conduct workshops on wage code compliance and statutory impact. |

| Communicate with Employees | Explain changes in take-home pay, PF deductions, and long-term benefits. |

| Maintain Documentation | Keep revised contracts, salary sheets, and audit trails for inspection. |

Conclusion

Restructuring employment contracts under India’s new Labour Codes is not just a compliance exercise, it is a chance to build transparency, trust, and long-term sustainability in the workplace. By aligning salary structures with the 50% wage rule, employers not only avoid penalties but also strengthen employee benefits like PF and gratuity. In a rapidly evolving labour landscape, those who adapt proactively will stand out as responsible, future-ready organizations. The message is clear: compliance today is the foundation of credibility tomorrow.

Join the Conversation

Your thoughts matter. Share your perspective in the comments—healthy dialogue helps us all understand labour law better.

Need Guidance?

Feel free to book a consultation. Expert advice can make compliance smoother and more effective.

Spread the Knowledge

If you found this article useful, don’t keep it to yourself—share it with colleagues, friends, or on social media. Together, we can build greater awareness of labour rights and responsibilities.

Disclaimer – This blog post is a general guide. It should not be considered legal advice. Consult a legal professional for more details.