Gratuity has long been a cornerstone of employee benefits in India, offering financial recognition for years of service. With the implementation of the new Labour Codes, the rules around gratuity have been clarified and expanded. While the five-year eligibility requirement for permanent employees remains unchanged, the Social Security Code 2020 introduces a significant amendment: fixed-term employees are now entitled to gratuity after completing just one year of service. This blog explores the applicability of gratuity under the new framework, its calculation, and what both employers and workers need to know.

Historical Context of Gratuity in India

- Introduced under the Payment of Gratuity Act, 1972, gratuity was designed as a retirement benefit.

- Traditionally, eligibility required five years of continuous service, except in cases of death or disability.

- Applicability extended to establishments with 10 or more employees, covering factories, mines, plantations, ports, and shops.

The new Labour Codes consolidate these provisions under the Social Security Code 2020, ensuring uniformity and reducing overlaps.

Key Amendments Under the Labour Codes

- Eligibility for Fixed-Term Employees

- Fixed-term employees are now entitled to gratuity after just one year of service, provided their contract duration is at least one year.

- This is a landmark change, recognizing the growing prevalence of short-term contracts in India’s gig-driven economy.

- Definition of Wages

- The Labour Codes introduce a standardized definition of “wages.”

- Employers must ensure that allowances do not reduce the basic wage below 50% of total remuneration.

- This impacts gratuity calculations, potentially increasing liability for employers.

- Coverage Across Establishments

- Gratuity continues to apply to all establishments employing 10 or more workers.

- The Labour Codes reinforce this coverage, ensuring consistency across industries.

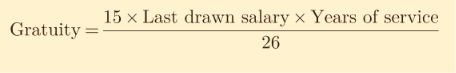

Calculation Method: Still Familiar, But With Nuances

Under the Payment of Gratuity Act, 1972 (now subsumed under the Social Security Code, 2020), the formula for calculating gratuity is:

Where:

- 15 = number of days’ wages for each completed year of service

- Last drawn salary = Basic + Dearness Allowance (not total CTC)

- 26 = number of working days in a month (used for daily wage conversion)

- Years of service = completed years (rounded down if not completed)

Common Misinterpretation

Many summaries incorrectly state “15 days’ wages per year” without dividing by 26, which overstates the amount. The division by 26 is essential to convert monthly salary into daily wages.

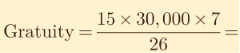

For Example,

Let us say an employee retires after 7 years of service with a last drawn Basic + DA of ₹30,000.

So, the employee is entitled to ₹1,21,154 (rounded off)

Under the New Labour Codes

- The formula remains unchanged.

- Fixed-term employees are now eligible for gratuity after one year of service, provided their contract duration is at least one year.

- The definition of “wages” has been standardized, which may affect the base used for gratuity calculation.

- Wages are calculated based on the last drawn salary, now defined more broadly.

- Employers must reassess payroll structures to avoid underestimating liabilities.

Employer Liabilities and Compliance Challenges

- Increased liability: With fixed-term employees now eligible, gratuity costs may rise.

- Payroll restructuring: Employers must align salary components with the new wage definition.

- Documentation: Appointment letters and contracts must clearly state gratuity entitlements.

- Timely payment: Gratuity must be disbursed within 30 days of termination or retirement, failing which interest is payable.

Worker Perspective: Why This Matters

- Greater inclusivity: Fixed-term and contract workers gain access to a benefit previously reserved for long-term staff.

- Financial security: Gratuity provides a safety net, especially in industries with high attrition.

- Empowerment: Workers in IT, gig platforms, and service sectors now enjoy parity with permanent employees.

Broader Implications

- Formalization of workforce: Extending gratuity to fixed-term employees encourages formal contracts.

- Ease of doing business vs. welfare: While employers face higher costs, the codes aim to balance growth with worker protection.

- Legal clarity: Consolidation reduces ambiguity, making compliance easier for businesses.

Key Takeaways

- Permanent employees: No change—five years of service required.

- Fixed-term employees: New inclusion—eligible after one year.

- Calculation: Unchanged.

- Wage definition: Broader, potentially increasing gratuity amounts.

- Employer obligations: Stronger compliance requirements, timely payments, and clear documentation.

Join the Conversation

Your thoughts matter. Share your perspective in the comments—healthy dialogue helps us all understand labour law better.

Need Guidance?

Feel free to book a consultation. Expert advice can make compliance smoother and more effective.

Spread the Knowledge

If you found this article useful, don’t keep it to yourself—share it with colleagues, friends, or on social media. Together, we can build greater awareness of labour rights and responsibilities.

Disclaimer – This blog post is a general guide. It should not be considered legal advice. Consult a legal professional for more details.