The Employees’ State Insurance Corporation (ESIC) has introduced a new wage definition under Section 2(88) of the Code on Social Security, 2020, effective from 21 November 2025. This change marks a significant shift in how contributions are calculated, potentially expanding ESIC coverage to lakhs of employees who were previously exempt. With the December 2025 Headquarters circular clarifying compliance requirements, employers now have a clearer roadmap for payroll structuring and statutory obligations.

Background: Why This Matters

- The Code on Social Security, 2020 standardizes wage definitions across labour laws.

- ESIC contributions will now be based on basic wages + dearness allowance + retaining allowance, with allowances exceeding 50% of total remuneration treated as wages.

- This change could increase the contributory wage base, especially for employees with allowance-heavy salary structures.

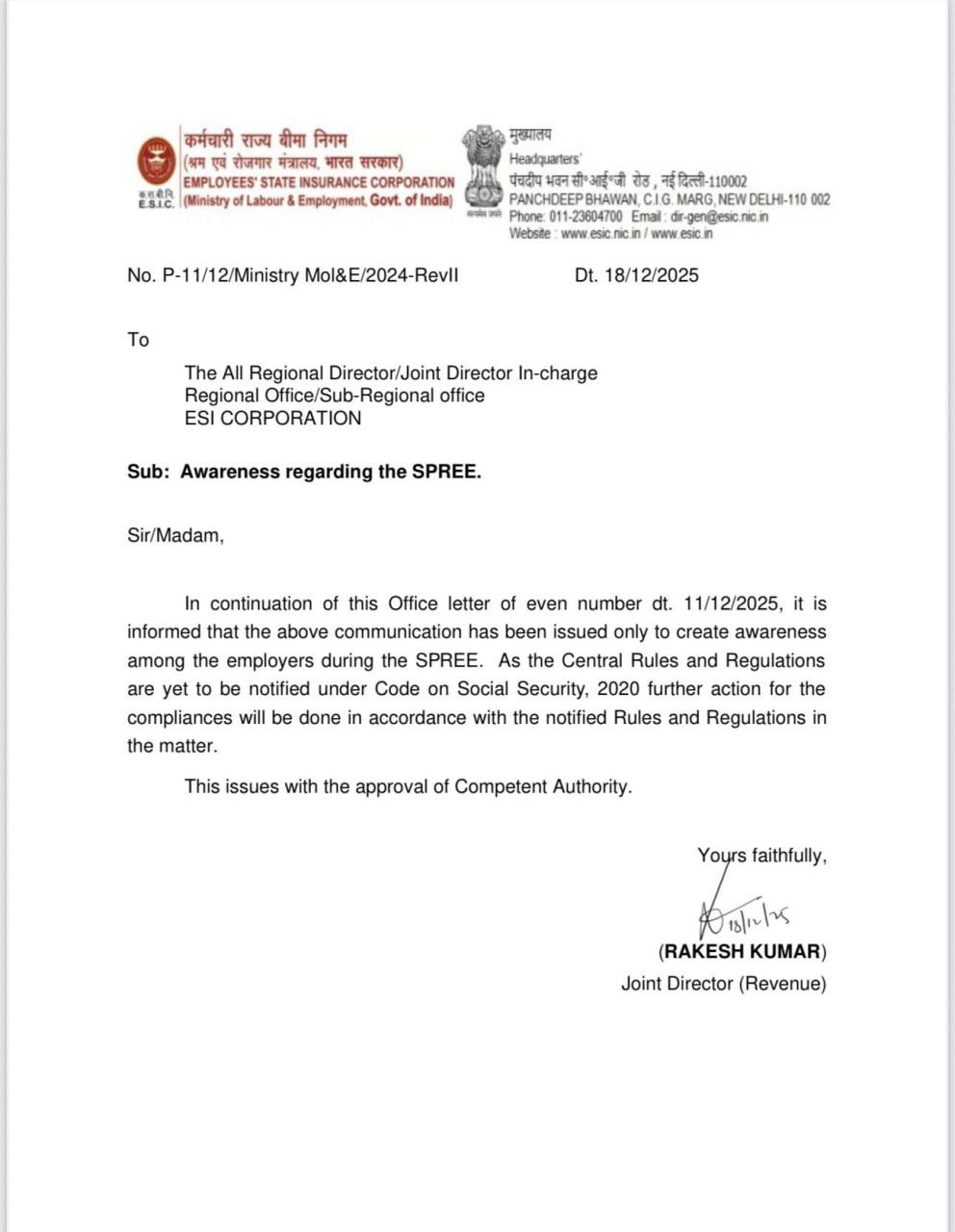

Key Clarifications from ESIC Headquarters

- Circulars issued by regional offices were awareness initiatives, not enforcement directives.

- Mandatory compliance begins only after Central Government notification of rules.

- Employers are advised to prepare but are not liable for penalties until formal enforcement.

Options Employers Can Explore

Employers have flexibility in how they respond to these changes. Here are some suggested approaches:

| Option | Description | Potential Impact |

| Wait for Notification | Hold off restructuring until official rules are published. | Avoids premature costs. |

| Scenario Planning | Run payroll simulations under the new wage definition. | Provides foresight into financial impact. |

| Voluntary Alignment | Gradually align salary structures with the new definition. | Smooth transition when rules are enforced. |

| Audit Readiness | Strengthen compliance documentation. | Reduces risk during inspections. |

| Employee Communication | Share transparent updates with staff. | Builds trust and reduces confusion. |

Practical Implications

- More employees will fall under ESIC coverage, especially in industries with fragmented wage structures.

- Payroll restructuring may be necessary to balance compliance with cost efficiency.

Key Takeaways

- The new wage definition is effective from 21 November 2025, but mandatory compliance awaits Central Government notification.

- Employers can choose to wait, plan, or voluntarily align salary structures.

- Preparing through simulations, audits, and communication strategies can ease the eventual transition.

Conclusion

The ESIC wage definition change under the Code on Social Security, 2020 is a landmark development in India’s labour compliance framework. While enforcement is not immediate, employers have the option to proactively prepare. By exploring payroll restructuring, compliance readiness, and transparent communication, organizations can position themselves for a smoother transition when the rules are formally notified.

Join the Conversation

Your thoughts matter. Share your perspective in the comments—healthy dialogue helps us all understand labour law better.

Need Guidance?

Feel free to book a consultation. Expert advice can make compliance smoother and more effective.

Spread the Knowledge

If you found this article useful, don’t keep it to yourself—share it with colleagues, friends, or on social media. Together, we can build greater awareness of labour rights and responsibilities.

Disclaimer – This blog post is a general guide. It should not be considered legal advice. Consult a legal professional for more details.