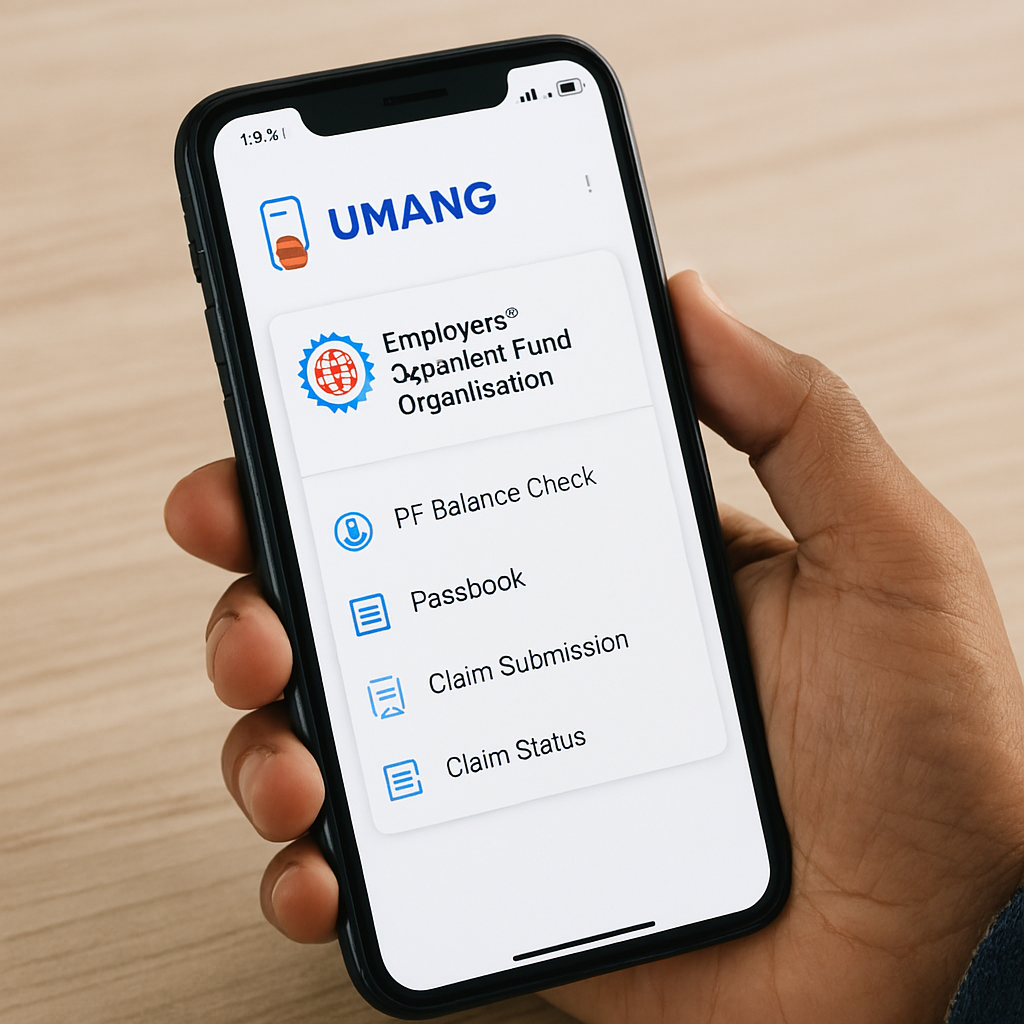

Have you ever stood in a long queue at an EPFO office, waiting for hours just to check your PF balance or submit a claim? What if all of that could be done in minutes, right from your smartphone? That’s exactly what the UMANG App delivers; a government-backed digital platform that integrates multiple citizen services, including the Employees’ Provident Fund Organisation (EPFO).

What is the UMANG App?

UMANG (Unified Mobile Application for New-Age Governance) is a flagship initiative by the Government of India. It consolidates services from various departments into one app, ensuring ease of access, transparency, and compliance. For EPFO members, this means no more paperwork hassles or delayed updates.

EPFO Services Available on UMANG

Here’s what employees and employers can do through the app:

- PF Balance Check: Instantly view your Provident Fund balance without visiting the office.

- Passbook Access: Download and track contributions from both employee and employer.

- Claim Submission: File withdrawal, transfer, or pension claims digitally.

- Claim Status Tracking: Know exactly where your application stands — no ambiguity.

- General Services: Locate EPFO offices, access grievance redressal, and update KYC details.

Legal Accuracy & Compliance

The UMANG App is directly integrated with EPFO’s official systems. This ensures:

- Authenticity: Data is sourced from EPFO’s secure servers.

- Compliance: Transactions comply with statutory requirements under the EPF Act, 1952.

- Transparency: Members can verify contributions and claims without intermediaries.

For employers, this digital access reduces compliance risks by ensuring employees’ PF records are updated and accessible.

Imagine Sameer, a factory worker in Khopoli, Maharashtra. Earlier, he had to take a day off to visit the EPFO office just to check his PF balance. Now, with UMANG, he logs in during his lunch break and sees his updated passbook in seconds. Isn’t that a game-changer?

Why Should You Care?

- Employees: Greater financial awareness and control over retirement savings.

- Employers: Reduced administrative burden and enhanced trust with employees.

- Society: A step toward digital governance and inclusive compliance.

Risks & Limitations

- Digital Literacy: Workers unfamiliar with smartphones may need guidance.

- Connectivity Issues: Rural areas may face challenges in accessing services.

- Data Security: While secure, users must avoid sharing login credentials.

Conclusion

The UMANG App is more than just a convenience tool; it’s a legal, transparent, and empowering platform that bridges the gap between statutory compliance and everyday accessibility. Whether you’re an employee tracking your PF or an employer ensuring compliance, UMANG makes the process seamless.

Join the Conversation

Your thoughts matter. Share your perspective in the comments—healthy dialogue helps us all understand labour law better.

Need Guidance?

Feel free to book a consultation. Expert advice can make compliance smoother and more effective.

Spread the Knowledge

If you found this article useful, don’t keep it to yourself—share it with colleagues, friends, or on social media. Together, we can build greater awareness of labour rights and responsibilities.

Disclaimer – This blog post is a general guide. It should not be considered legal advice. Consult a legal professional for more details.