The Employees Provident Fund Organisation (EPFO) has taken a major digital leap by introducing Aadhaar-based Face Authentication for generating and activating the Universal Account Number (UAN). This new system eliminates dependency on employers, reduces data-entry errors, and makes onboarding into the EPF ecosystem faster and more secure. If you are a new employee or someone struggling with UAN activation, this guide explains how the new face-authentication process works and why it matters for your EPF access.

Why EPFO Introduced Face Authentication for UAN

For years, UAN generation was largely dependent on employers. While the system worked in principle, it often resulted in:

Frequent Data Errors

Incorrect names, mismatched mobile numbers, and spelling mistakes were common because employers manually entered employee details.

Delayed UAN Sharing

Many employees were unaware of their UAN because employers did not communicate it promptly.

Low Activation Rates

In FY 2024–25, EPFO allotted over 1.26 crore UANs, but only around 35% were activated.

The primary reason:

Activation required Aadhaar OTP verification, which often failed due to outdated mobile numbers or technical issues.

These challenges restricted employees from accessing essential EPFO services such as passbook viewing, KYC updates, and online claim submissions.

How the New Aadhaar-Based Face Authentication System Works

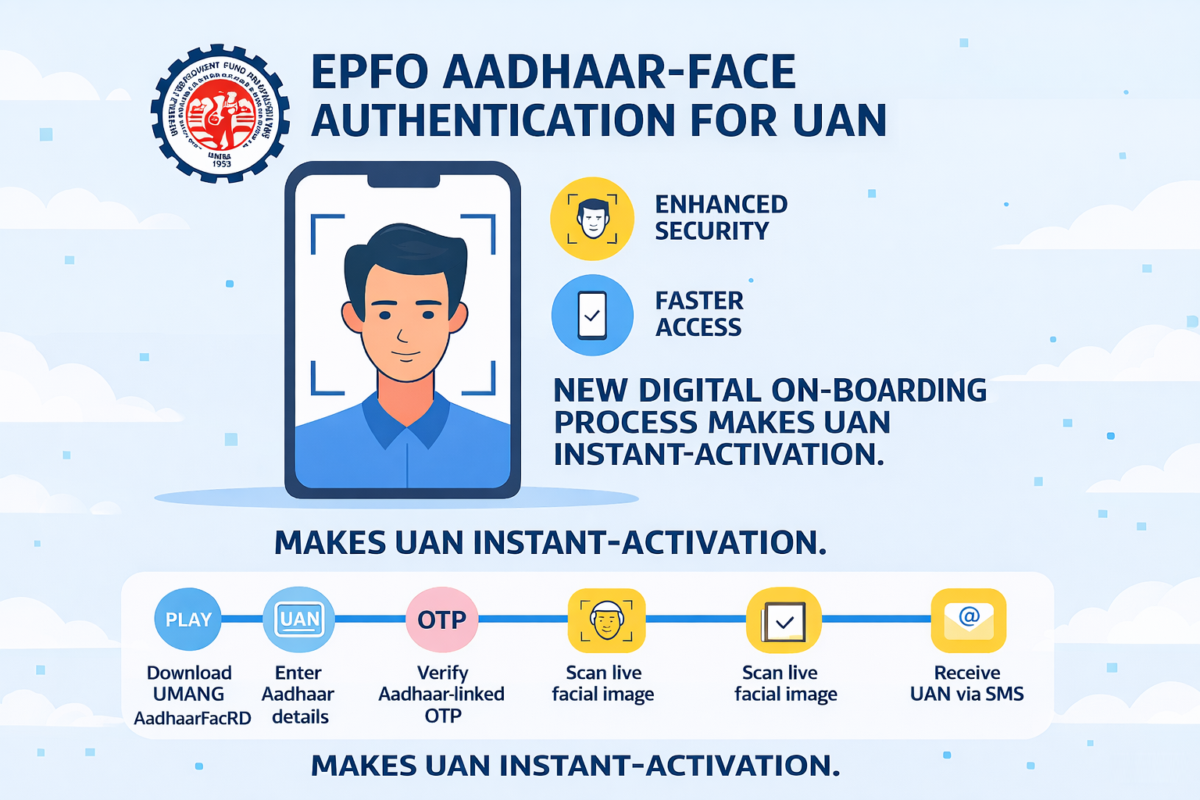

EPFO’s new system allows employees to generate and activate their UAN independently using the UMANG app and the AadhaarFaceRD app. The process is designed to be simple and fully digital.

Step-by-Step Process

1. Download the UMANG and AadhaarFaceRD apps from the Play Store.

2. Open UMANG and go to UAN Services → UAN Allotment and Activation.

3. Enter your Aadhaar number and the mobile number linked to Aadhaar.

4. Provide consent and verify the OTP sent to your Aadhaar-linked mobile.

5. Use your phone’s camera to capture a live facial image.

6. The system compares your live photo with Aadhaar records.

7. Once verified, your UAN is generated instantly and sent via SMS.

8. The UAN is auto-activated, allowing you to download your e-UAN card immediately.

This process removes the need for employer involvement and ensures that the employee’s identity is validated directly through Aadhaar.

Key Advantages of Aadhaar-Based Face Authentication

EPFO’s new system brings several improvements to the UAN onboarding experience:

- Accurate Identity Verification

Face matching ensures 100% identity validation, reducing the risk of impersonation or incorrect data entry. - Automatic Mobile Number Verification

Since the mobile number linked to Aadhaar is used, there is no need for manual verification. - No Employer Dependency

Employees can generate and activate their UAN independently, eliminating delays caused by employer oversight. - Instant UAN Activation

The UAN becomes active immediately after generation, enabling instant access to EPFO services such as:- EPF passbook

- KYC updates

- Online claims

- e-Nomination

- Reduction in Errors and Rejections

Since Aadhaar data is used directly, the chances of mismatched details or rejected KYC requests are significantly reduced.

EPFO’s Next Step: Extending Face Authentication to Pensioners

EPFO is also expanding the use of face authentication for pensioners.

Under this initiative:

- Pensioners will be able to submit their Digital Life Certificate (DLC) using face authentication through the Jeevan Pramaan system.

- EPFO is collaborating with My Bharat to deploy trained youth volunteers who will assist pensioners at their homes or community centers.

This ensures that elderly pensioners—especially those with mobility challenges—can complete their annual life certificate submission without difficulty.

Conclusion

EPFO’s Aadhaar-based Face Authentication for UAN generation is a major step toward a fully digital and employee-centric provident fund system. By eliminating employer dependency, reducing errors, and enabling instant activation, the new process empowers employees with faster and more reliable access to their EPF accounts. With plans to extend the same technology to pensioners, EPFO is moving toward a more inclusive and accessible digital ecosystem for all its members.

Join the Conversation

Your thoughts matter. Share your perspective in the comments-healthy dialogue helps us all understand labour law better.

Need Guidance?

Feel free to book a consultation. Expert advice can make compliance smoother and more effective.

Spread the Knowledge

If you found this article useful, don’t keep it to yourself—share it with colleagues, friends, or on social media. Together, we can build greater awareness of labour rights and responsibilities.

Disclaimer – This blog post is a general guide. It should not be considered legal advice. Consult a legal professional for more details.