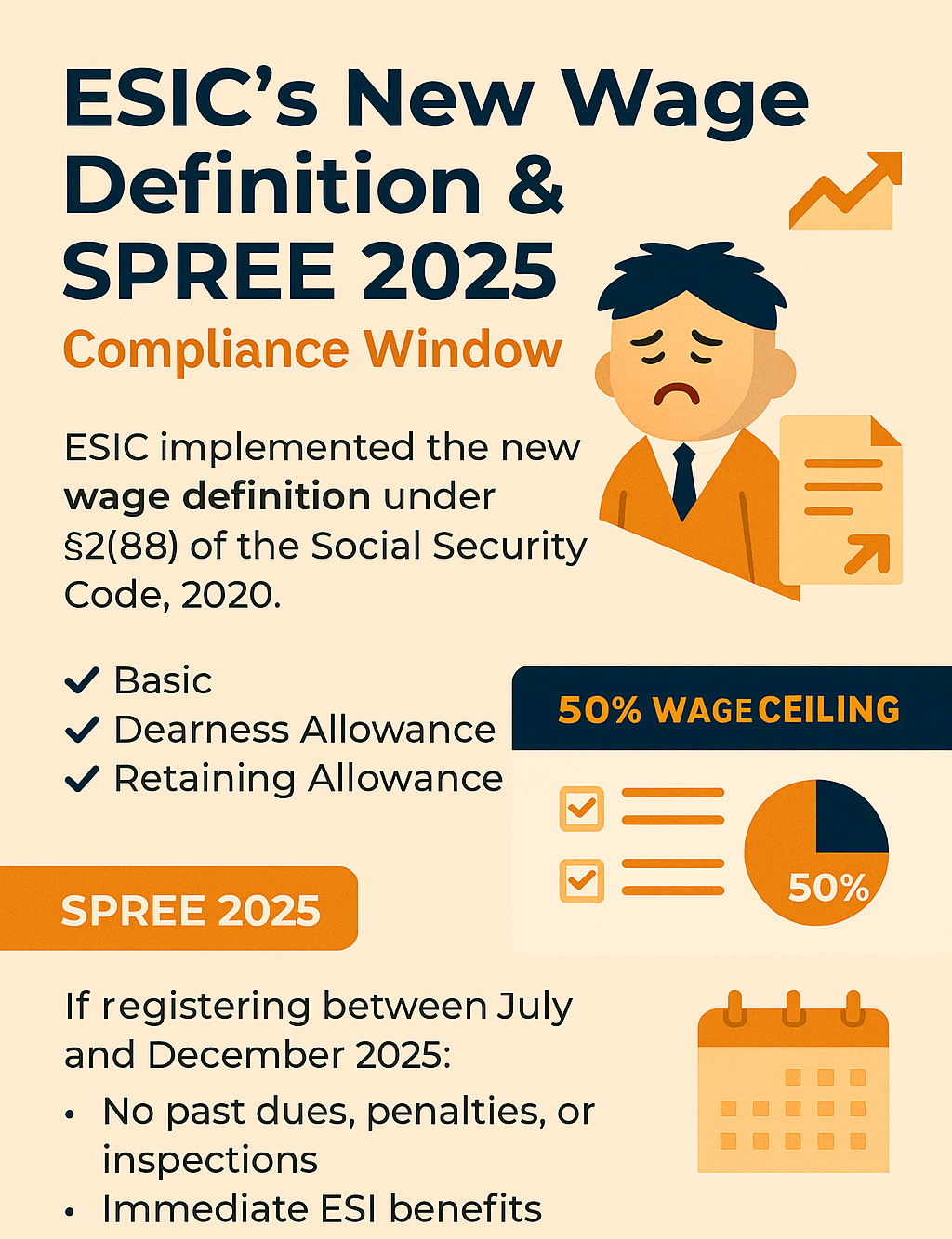

The Employees’ State Insurance Corporation (ESIC) has formally implemented the new wage definition under Section 2(88) of the Code on Social Security, 2020, triggering a nationwide compliance drive across India. With the launch of SPREE 2025, a one-time registration window open until December 31, 2025 employers must reassess employee coverage, restructure payroll, and align contributions with the 50% wage ceiling rule. This blog breaks down the ESIC notification, the new wage logic, and the practical steps employers must take to remain compliant and avoid penalties.

What Counts as “Wages” Now?

Included:

- Basic Pay

- Dearness Allowance (DA)

- Retaining Allowance (RA)

Excluded (subject to 50% cap):

- HRA

- Conveyance allowance

- Overtime

- Commission

- Statutory bonus

- Employer PF contribution

- Gratuity

- Value of housing, water, light, medical facilities

- Reimbursements for employment-related expenses

The 50% Ceiling Rule

If excluded components exceed 50% of total remuneration, the excess must be added back to “wages” for ESI calculation. This rule ensures that employers cannot structure salaries to avoid ESI liability.

SPREE 2025: A One-Time Compliance Opportunity

SPREE 2025 (Scheme for Promotion of Registration of Employers and Employees) is a special initiative by ESIC offering a one-time registration window from 1 July to 31 December 2025.

Key Benefits:

- No demand for past dues or penalties

- Immunity from inspections and punitive action

- Immediate access to ESI benefits for employees

- Hassle-free digital registration via ESIC, Shram Suvidha, or MCA portals

Who Must Register:

- All establishments covered under Section 2(29) of the Code

- All eligible employees, including contractual and outsourced workers

- Employees earning above ₹21,000 may still qualify if their recalculated “wages” fall below the threshold

Salary Structure Examples: How the 50% Rule Works

ESIC’s notification includes detailed illustrations showing how salary components must be recalculated. These examples demonstrate:

- When allowances exceed 50%, the excess is added back

- Employees previously outside ESI may now become eligible

- ESI wages may increase even if basic pay is low

Mandatory Compliance Steps for Employers

- Reassess ESI applicability for all employees

- Register under SPREE 2025 before 31 December

- Update payroll structures to comply with Section 2(88)

- Complete Aadhaar-based enrolment and issue E-Pehchan Cards

- Deposit contributions on the revised wage base

- Verify contractor compliance to avoid principal employer liability

- Maintain inspection-ready records and avoid artificial wage bifurcation

Consequences of Non-Compliance

Non-compliance under the Code on Social Security, 2020 may result in:

- Recovery of dues as arrears of land revenue

- Mandatory interest and penal damages

- Criminal prosecution

- Loss of statutory benefits for employees

- Litigation before ESIC authorities and courts

These consequences are cumulative and coercive.

Strategic Takeaways for Employers

- The new wage definition is now enforceable under ESIC

- SPREE 2025 offers a rare compliance amnesty

- Payroll restructuring is mandatory under Section 2(88)

- Early compliance is the best defense against penalties and litigation

- Legal review and documentation are essential in 2025

Absolutely — here is a strong, authoritative, and publication-ready conclusion tailored to your revised ESIC-only blog. It maintains legal accuracy, avoids any EPFO references, and reinforces the compliance message clearly and professionally.

Conclusion

The ESIC’s implementation of the new wage definition under Section 2(88) of the Social Security Code, 2020 marks a decisive shift toward transparent, uniform, and substance-based compliance. With the 50% wage ceiling rule now fully operational and SPREE 2025 offering a one-time opportunity to regularize establishments and employees, employers can no longer rely on legacy payroll structures or fragmented interpretations of “wages.” The responsibility now lies squarely with establishments to reassess eligibility, restructure salary components, and ensure timely registration and contribution deposits.

The message from ESIC is unambiguous: compliance must reflect the true nature of remuneration, not its form. Employers who act early by reviewing wage structures, enrolling all eligible workers, and leveraging the SPREE 2025 window will not only avoid penalties but also strengthen their statutory protection and employee welfare framework. As India transitions into a harmonized social security regime, proactive compliance is no longer optional; it is a strategic necessity for every responsible employer.

Join the Conversation

Your thoughts matter. Share your perspective in the comments—healthy dialogue helps us all understand labour law better.

Need Guidance?

Feel free to book a consultation. Expert advice can make compliance smoother and more effective.

Spread the Knowledge

If you found this article useful, don’t keep it to yourself—share it with colleagues, friends, or on social media. Together, we can build greater awareness of labour rights and responsibilities.

Disclaimer – This blog post is a general guide. It should not be considered legal advice. Consult a legal professional for more details.